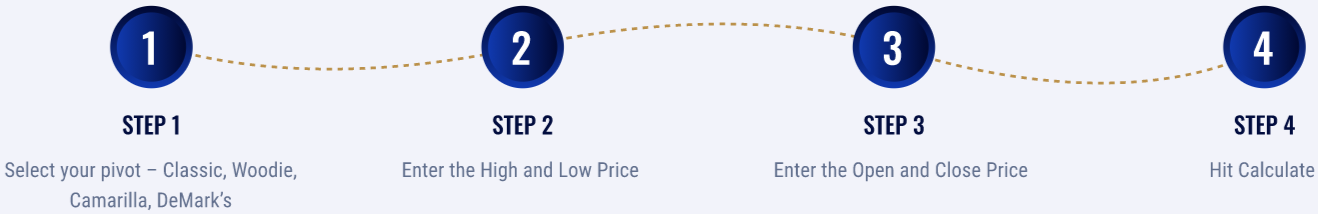

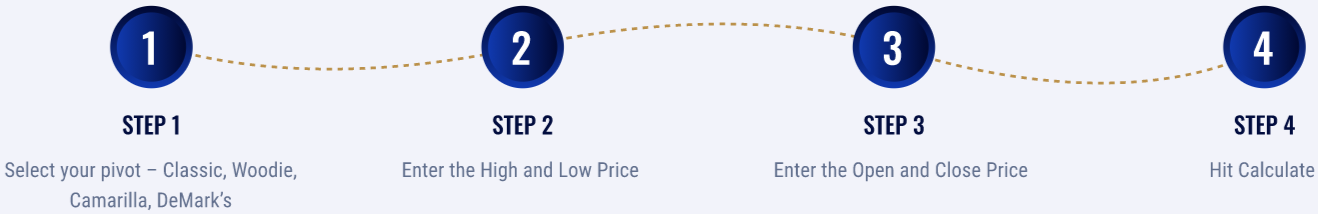

HOW TO USE THE PIVOT CALCULATOR:

Pivot points can be used in identifying reversal or breakout areas. You can calculate significant daily, weekly, and monthly support and resistance levels with the help of our pivot point calculator.

Pivot points are especially useful for short-term traders who are looking to take advantage of small price movements in the market. As with normal support and resistance levels, traders can choose to trade the bounce or the break of these levels.

Classic

Woodie

Camarilla

DeMark

High Price

Low Price

Open Price

Close Price

| 4th Resistance | 0 |

|---|---|

| 3rd Resistance | 0 |

| 2nd Resistance | 0 |

| 1st Resistance | 0 |

| Pivot Point | 0 |

| 1st Support | 0 |

| 2nd Support | 0 |

| 3rd Support | 0 |

| 4th Support | 0 |

| Selected Pivot: | Classic | ||

|---|---|---|---|

| High Price: | 5.00 | Open Price: | 2.00 |

| Low Price: | 1.00 | Close Price: | 3.00 |

| Results | |||

| 4th Resistance: | - | 3rd Resistance: | 9.0000 |

| 2nd Resistance: | 7.0000 | 1st Resistance: | 5.0000 |

| Pivot Point: | 3.0000 | 1st Support: | 1.0000 |

| 2nd Support: | 1.0000 | 3rd Support: | 3.0000 |

| 4th Support: | - | ||

Classic is the most basic and popular type of pivot. The pivot point is interpreted as the primary support/resistance level – the point at which the main trend is determined.

Woodie’s pivot points are similar to Classic. The difference being is that more emphasis is given to the Close price of the previous period.

Camarilla pivot points are a set of eight possible levels of support and resistance values for a current trend. The most important consideration is that these pivot points work for all traders and will help set correct stop-loss and profit-target positions.

A very popular method of calculating pivots is Tom DeMark’s pivot points. While not quite pivot points they can be used to forecast the future of the trend. The main appeal of these pivot points is to predict the lows and highs of a trading period.