Want to trade an asset at a lower cost and higher leverage? You should consider Contract for Difference (CFDs) trading. CFDs enable traders to speculate on the price movements of various assets without owning them.

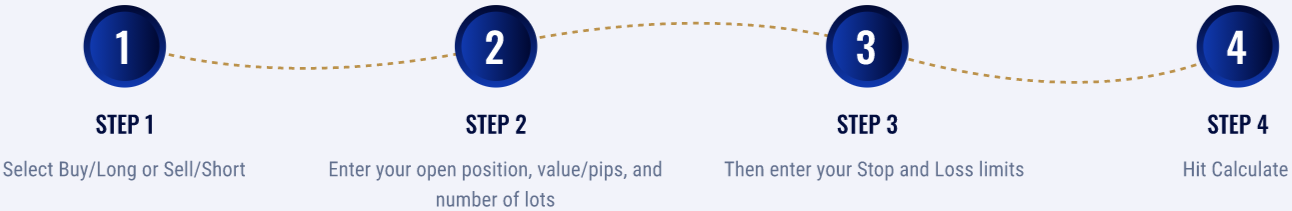

You can profit regardless of whether an asset’s value increases or decreases. What’s more, you can increase your profit potential through leverage. Use our Stop/Loss calculator to accurately determine the outcome of a potential trade.

Buy / Long

Sell / Short

Open

Value/Pip

Lots

Stop

Limit

| Max Loss | Max Profit |

0:00 |

0:00 |

| Open: | 0.9 | Value/Pip: | 0.01 |

|---|---|---|---|

| Lots: | 5.00 | Stop: | 0.8 |

| Limit: | 1.5 | ||

| Results | |||

| Max Loss: | 50.00 | Max Profit: | 300.00 |

WHAT ARE CFDS?

WHAT ARE CFDS? CFDs are bought and sold like any tradable asset, the difference is you don’t have to own the underlying asset or instrument you’re trading.

CFDs are bought and sold like any tradable asset, the difference is you don’t have to own the underlying asset or instrument you’re trading.

It is a contract between two parties, described as “buyer” and “seller”.

It is a contract between two parties, described as “buyer” and “seller”.

If you believe the price of Gold is going up, you would buy a Gold CFD and you would then close the position by selling the CFD. Your profit (or loss) would be the difference in the price of the CFD between the time you entered and closed your position.

If you believe the price of Gold is going up, you would buy a Gold CFD and you would then close the position by selling the CFD. Your profit (or loss) would be the difference in the price of the CFD between the time you entered and closed your position.

CFD trading also allows traders to leverage their capital by trading amounts far higher than the funds in their accounts.

CFD trading also allows traders to leverage their capital by trading amounts far higher than the funds in their accounts.